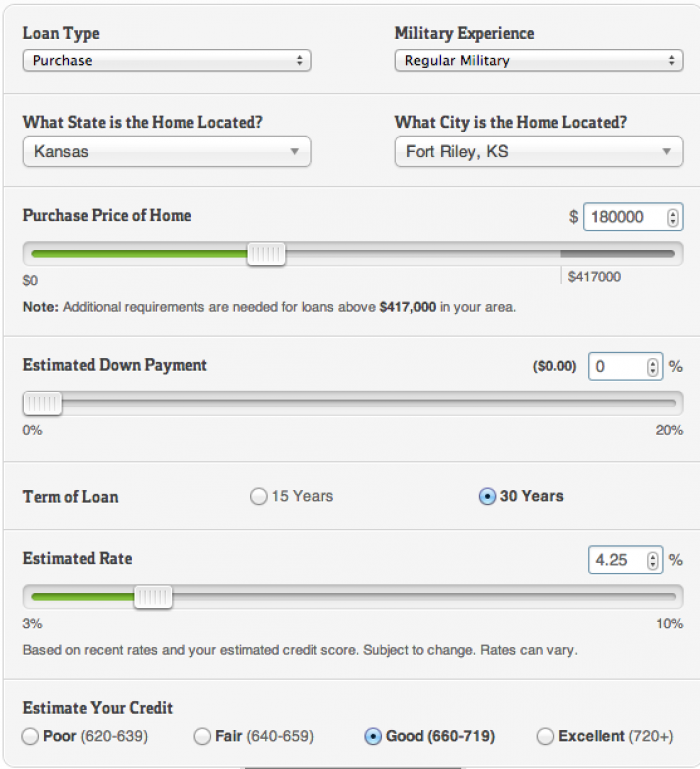

Principal:This is the total amount of money you borrow from a lender. Check your VA home loan eligibility today.A mortgage payment typically consists of four components, often referred to as PITI: principal, interest, taxes, and insurance. Many active-duty servicemembers and veterans are eligible to purchase a home with zero down payment and a low monthly payment - many just don’t know it yet. If you’re a homebuyer with military experience, then see if a VA loan is the right mortgage loan product for you. There are no official limits.īut remember, you’ll still have to qualify for the mortgage. Department of Veterans Affairs VA loan limitsĪs of January 1, 2020, VA-eligible borrowers can get any size loan with no down payment. Property meets VA minimum property requirements.1-2 years of consistent employment history.

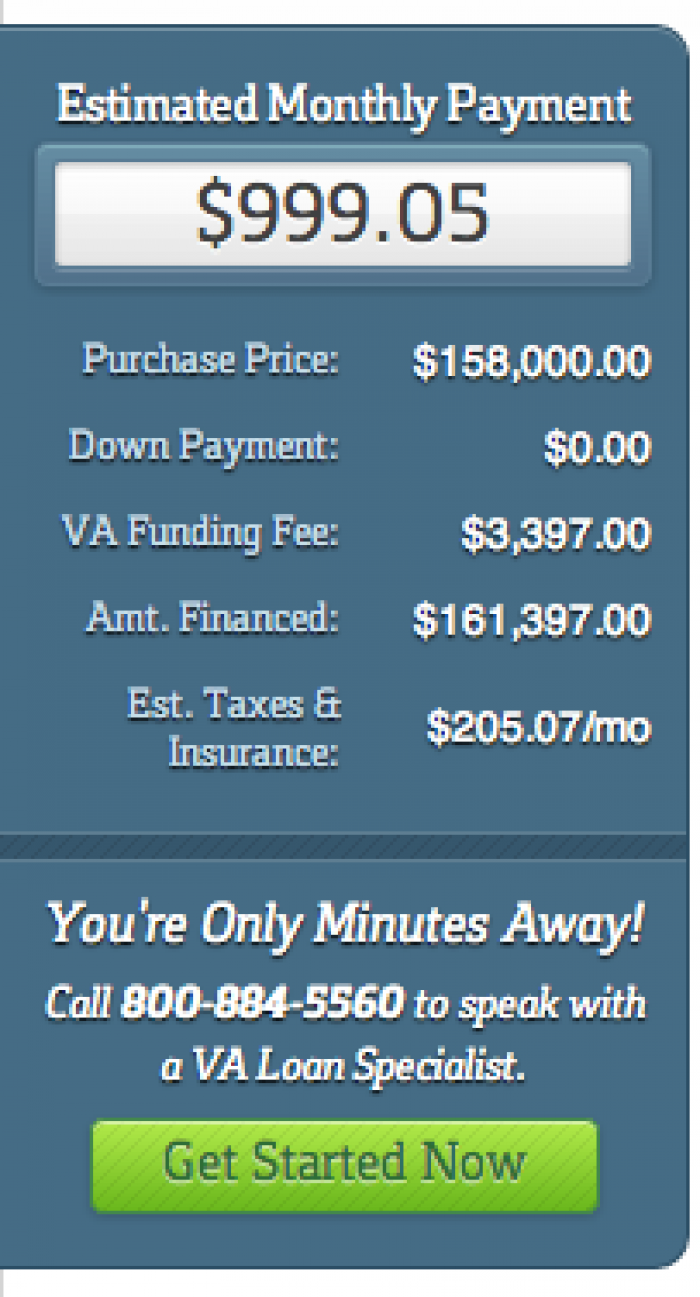

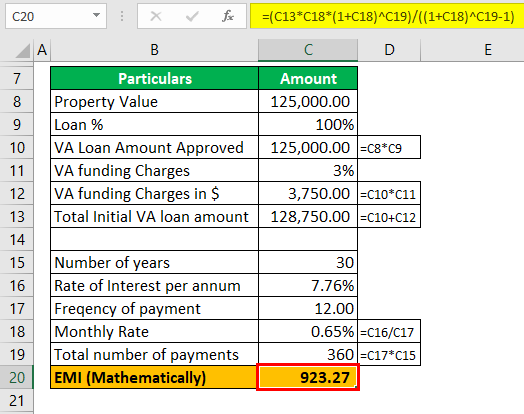

If you’re buying a condo or a home in a Planned Unit Development (PUD), you’ll likely be responsible for homeowners association (HOA) dues. The most common funding fee is 2.3% of the loan amount - or $2,300 for each $100,000 borrowed. The percentage you’ll be charged will depend on your down payment and whether you’ve used a VA loan before. The fee is either wrapped into the loan amount or paid in cash at closing.įunding fee percentage. It’s why lenders are able to offer zero-down loans with low rates. The VA requires an upfront, one-time funding fee payment to help sustain the program. The VA requires no down payment, unlike other loan types, which generally require at least 3 to 10 percent.įunding fee. This is the amount you put towards the purchase of your home. Not only will this ensure you’re getting the best rate, you may be able to negotiate better terms and fees for your loan as well.ĭown payment. More buying power (lower mortgage payments mean you can afford a more expensive home)Įach lender offers different interest rates and terms, it’s best to comparison shop with multiple lenders.Lower overall interest costs over the life of the loan.Qualifying for the lowest possible rate gives home buyers three distinct advantages: Qualifying for a low-interest rate is important for VA home buyers. Interest rates vary and depend on multiple factors like credit score, down payment amount, and interest rate type, so every home buyer’s rate is unique to their situation. For example, Ellie Mae October 2020 Origination Report shows that the average interest rate for VA home loans is 2.75%, while the average interest rate for both conventional loans and FHA loans is 3.01%.

In fact, VA mortgage rates today are generally lower than other loan types like conventional and FHA. Mortgage rates for VA home loans are currently at historic lows. A VA loan calculator can help you determine what your potential VA loan payment might be and, in turn, what home purchase price you can afford.

0 kommentar(er)

0 kommentar(er)